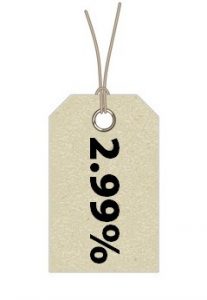

The Reserve Bank Board met in an emergency meeting today and voted to cut the Official Cash Rate to a new record low 0.25%

The Prime Minister has strongly urged banks to pass on this rate cut in full to support Australian families to cope with the negative financial impact of the COVID-19 pandemic.

The vast majority of banks passed on the full 0.25% rate cut announced earlier this month and borrowers will be pressuring banks to repeat this action.

If you have any concerns regarding your Home Loan please click on CONTACT US or call (07) 55 274 744