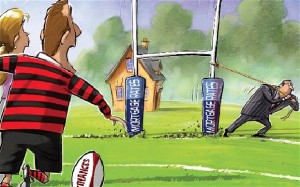

QUESTION … Do the Banks add the commission paid to my Mortgage Broker onto my Home Loan?

ANSWER … No !!!

Reason … Banks are more than willing to absorb 100% of the cost to pay your Mortgage Broker as this expense is significantly lower than the costs the Bank would incur to employ more Lending Managers.

Mortgage Managers (e.g. Aussie Home Loans + RAMS Home Loans) do take into account all acquisition and business costs within their interest rate charges however, the vast majority of Mortgage Managers charge the same interest rates or lower for clients utilising the services of Mortgage Brokers.

For more information please feel free to contact our Mortgage Specialists.